Case Studies: Successful Sports Simulation Installations

- Why sports simulation is reshaping modern entertainment venues

- Case Study 1 — Topgolf: scaling sports simulation into a global entertainment brand

- Case Study 2 — Golfzon and indoor golf chains: compact simulators as high-margin anchors

- Case Study 3 — Batting & baseball simulators (HitTrax): performance training + entertainment

- Case Study 4 — Multi-attraction FEC integration: combining AR sports simulators and projection

- Comparing sports simulation technologies and business fit

- KPIs to measure after installation: how to evaluate sports simulation ROI

- Choosing the right vendor: technical and commercial checklist

- JAMMA Amusement: one-stop sports simulation and amusement solutions

- Implementation checklist and common pitfalls

- Frequently Asked Questions (FAQ)

- 1. What is the typical payback period for a sports simulator installation?

- 2. How much space is required for a single sports simulator bay?

- 3. Can sports simulators generate revenue outside peak hours?

- 4. What ongoing costs should operators budget for?

- 5. Do simulators need dedicated staff or can they be self-service?

- 6. How do I choose between a training-grade simulator and an entertainment-focused system?

- Next steps and contact / product demo

- References

Why sports simulation is reshaping modern entertainment venues

Sports simulation has evolved from a niche training tool to a core revenue driver for family entertainment centers (FECs), golf entertainment complexes, and multi-attraction venues. Operators use sports simulators to increase dwell time, diversify guest profiles, and create year-round, weather-independent revenue. This article reviews documented case studies and technology comparisons to help venue owners, operators, and investors evaluate sports simulation installations and forecast realistic outcomes.

Case Study 1 — Topgolf: scaling sports simulation into a global entertainment brand

keyword: sports simulation installations for entertainment venues

Background: Topgolf transformed the driving range into an entertainment-first sports simulation experience, combining microchipped balls, climate-controlled hitting bays, food & beverage, and music. The concept scaled rapidly across North America, Europe, and Asia, illustrating how sports simulation can anchor large-format entertainment venues.

Why it worked: Topgolf’s model couples a simulation-based activity (point-scoring golf games) with hospitality and event programming. The simulation is simple to use for casual players, lowering the barrier to entry compared with traditional golf.

Measured outcomes: Topgolf’s public filings and business reporting indicate consistently strong same-store sales growth and high repeat visitation driven by social play and events. While Topgolf’s model is larger than a single simulator room, it demonstrates key performance markers venues can target: multipurpose revenue streams (game fees + F&B + events), extended dwell time, and higher per-guest spend.

Lessons for operators: When designing sports simulation installations, integrate hospitality, event capacity, and easy-to-understand gameplay. Invest in reliable hardware and UX because guest throughput and uptime directly affect ticket yield and F&B revenue.

Case Study 2 — Golfzon and indoor golf chains: compact simulators as high-margin anchors

keyword: buy sports simulator for golf centers

Background: Golfzon (Korea) and its global partners supply compact golf simulators to golf centers, driving ranges, and shopping-mall entertainment floors. These systems prioritize accurate ball flight simulation, coaching modes, and replay tools, making them attractive to both serious golfers and casual players.

Why it worked: Golfzon’s B2B focus, service network, and content ecosystem allowed operators to offer hourly simulator rentals, membership packages, and lesson packages. Small-footprint simulator bays fit into malls and existing FECs, enabling fast installation and quick returns.

Measured outcomes: Operators typically report high margin on hourly simulator fees and upsell opportunities for coaching and membership. Case examples published by simulator vendors show payback periods ranging from 12–24 months in high-traffic urban centers (actual results depend on rent, labor, and local demand).

Lessons for operators: Choose a simulator vendor with strong local support and flexible software licensing. A networked content library and coach tools improve utilization and recurring revenue.

Case Study 3 — Batting & baseball simulators (HitTrax): performance training + entertainment

keyword: sports simulator ROI for training centers

Background: HitTrax and similar systems combine ball-tracking sensors and projection to create realistic batting and pitching simulation for baseball and softball facilities. These systems are used by training academies, colleges, and some FECs to attract young athletes and their families.

Why it worked: The combination of measurable performance analytics (exit velocity, launch angle) and gamified modes creates a dual-purpose product—elite training by day and family entertainment by night. That dual use increases utilization and broadens the addressable market for a single unit.

Measured outcomes: Independent facility reports and vendor case studies show improved retention of youth athletes and higher off-peak usage. Several training centers reported that adding analytics-driven simulators enabled High Quality lesson pricing and increased membership sign-ups.

Lessons for operators: If targeting athlete development, prioritize accuracy (validated sensor data) and coach integration. If targeting entertainment, include gamification and cross-promotional event programming.

Case Study 4 — Multi-attraction FEC integration: combining AR sports simulators and projection

keyword: sports simulation equipment for family entertainment centers

Background: Several mid-size FECs integrated AR sports simulators and interactive projection games to diversify their attractions. These systems are typically lower-footprint than full golf bays but highly engaging for families and corporate groups.

Why it worked: Interactive projection and AR sports simulate inclusive play (kids, teens, adults) and are easy to staff. They drive cross-attraction traffic—families come for the projection games and then add simulator sessions, F&B, and arcades.

Measured outcomes: Operators reported increases in per-visit spend and average dwell time; typical uplift ranges (reported by operators and aggregated by industry groups) are +15–35% in venues where simulators were part of a deliberate attraction mix.

Lessons for operators: Focus on simple onboarding flows, multi-player modes, and staff training to maximize throughput. Use promotional bundles (simulator + F&B) to maximize conversion and average spend.

Comparing sports simulation technologies and business fit

keyword: sports simulation technology comparison

| Technology / Brand | Primary Use | Space / Footprint | Typical CapEx Range (est.) | Best For |

|---|---|---|---|---|

| Topgolf-style bays (custom systems) | Social golf entertainment, high throughput | Large (multi-bay venues) | High (site build + integration) | Large entertainment complexes, F&B integrated venues |

| Golfzon / Full Swing / TrackMan simulators | Golf simulation, training, hourly rental | Medium to small (single bays) | Medium–High (hardware + software) | Golf centers, shopping-mall FECs, private clubs |

| HitTrax / Rapsodo (baseball/softball) | Performance analytics + entertainment | Small–Medium (netted bays) | Low–Medium | Training academies, youth-based facilities |

| AR Interactive Projection systems | Casual sports games, family play | Small (open floor) | Low–Medium | FECs, malls, indoor playgrounds |

Sources: vendor product pages (TrackMan, Golfzon, HitTrax) and industry benchmarking reports (see references).

KPIs to measure after installation: how to evaluate sports simulation ROI

keyword: sports simulator ROI metrics

Key performance indicators to monitor:

- Utilization rate: percentage of available hours booked; target 40–70% in year 1 depending on location.

- Average revenue per session (including upsells): critical to forecast payback.

- Incremental F&B spend per simulator guest: integrated venues often see higher per-guest F&B revenue.

- Repeat visitation and memberships: measure loyalty uplift.

- Uptime and maintenance costs: downtime reduces realized ROI sharply.

Operational tip: Start with a pilot bay or pop-up to validate local demand, then scale. Use dynamic pricing (peak vs off-peak), memberships, and lesson packages to maximize yield.

Choosing the right vendor: technical and commercial checklist

keyword: buy sports simulation equipment checklist

Before purchase, validate:

- Hardware accuracy and third-party validation (important for training-focused installs).

- Software content library and licensing terms.

- Local technical support and spare parts availability.

- Integration with POS, booking systems, and CRM.

- Warranty, SLA, and staff training packages.

Vendors that offer turnkey installation, training, and after-sales service typically reduce operational risk and shorten time-to-profit.

JAMMA Amusement: one-stop sports simulation and amusement solutions

keyword: sports simulation suppliers for venues

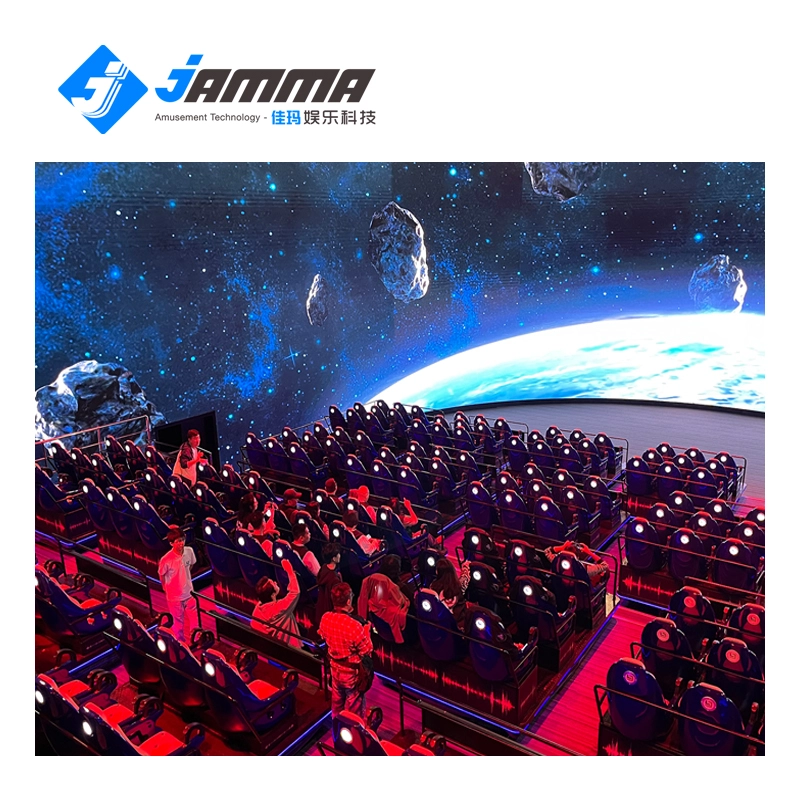

JAMMA Amusement was established in 2009 in Guangzhou and has 15 years of experience in the amusement industry. We focus on high-value, one-stop solutions for amusement projects. Our product range includes VR games, AR sports simulators, AR interactive projection games, 5D cinema, arcade games, and outdoor playground equipment.

Key strengths and differentiators:

- Industry experience: 15 years of product development and installation experience across global markets.

- Technical R&D: Our in-house technical team continuously develops and updates simulators, emphasizing reliability and UX to maximize venue throughput.

- International sales & service: an efficient international sales team provides consultative pre-sales support and professional solutions tailored to venues.

- Manufacturing & support: skilled manufacturing and after-sales teams offer fast spare-parts supply, preventive maintenance plans, and remote diagnostics.

- Product focus: Sports Simulators, Interactive Projection Games, Immersive Attractions, and VR Games—designed to work alone or in integrated attraction mixes.

How JAMMA helps operators succeed:

- Feasibility studies and site layout recommendations to optimize throughput and F&B synergies.

- Custom software modes and branding to fit event programming and local markets.

- Training programs for venue staff and ongoing technical support to maintain uptime.

Contact JAMMA or view our product catalog to request case-specific ROI models and site planning guidelines: https://www.jammapark.com/

Implementation checklist and common pitfalls

keyword: install sports simulator guide

Common pitfalls to avoid:

- Underestimating staffing needs during peak times—simulators require onboarding and basic supervision.

- Poor integration with F&B and POS—booking and payment friction reduces conversion.

- Neglecting maintenance contracts—delays in repairs reduce utilization quickly.

- Choosing the wrong content mix—serious training features may alienate casual users and vice versa.

Checklist for a successful launch:

- Run a market test or pilot unit for 3–6 months.

- Train staff on fast onboarding routines and basic troubleshooting.

- Bundle offers with F&B and events to drive multi-hour visits.

- Monitor KPIs weekly during the first 3 months and adjust pricing or programming.

Frequently Asked Questions (FAQ)

keyword: sports simulation FAQ

1. What is the typical payback period for a sports simulator installation?

Answer: Payback periods vary by format and location. For compact simulator bays in high-traffic urban centers, operators often target 12–24 months. Large integrated sites (Topgolf-style) require longer development times but can scale revenue significantly. Pilot testing and conservative financial modeling are essential.

2. How much space is required for a single sports simulator bay?

Answer: Space requirements depend on sport and technology. Golf bays usually require 12–18 ft depth and 10–15 ft width per bay; batting nets require smaller footprints. AR projection systems may only need an open floor of 6–10 m across. Confirm vendor specifications during site planning.

3. Can sports simulators generate revenue outside peak hours?

Answer: Yes. Use off-peak promotions, lessons, corporate packages, and leagues to increase utilization. Analytics-driven offerings and memberships help stabilize revenue across the week.

4. What ongoing costs should operators budget for?

Answer: Budget for software licensing, periodic calibration, wear parts (sensors, nets, projector lamps if applicable), and a maintenance SLA. Many vendors offer service packages that smooth these costs.

5. Do simulators need dedicated staff or can they be self-service?

Answer: Many systems can run self-service for casual play, but staffing improves throughput, guides onboarding, and increases upsells. Training staff to operate simulators efficiently is recommended for revenue optimization.

6. How do I choose between a training-grade simulator and an entertainment-focused system?

Answer: Define your core customer. If your venue targets serious golfers and coaches, prioritize accuracy and analytics. If your aim is family entertainment, choose systems with easy onboarding, gamified content, and social modes.

Next steps and contact / product demo

If you are evaluating sports simulation installations for your venue, start with a feasibility conversation. JAMMA Amusement offers consultation, pilot units, and turnkey installations tailored to FECs, golf centers, and multi-attraction parks. Visit https://www.jammapark.com/ to request a site-specific proposal or product demo. Our team can provide projected KPIs and scheduling plans based on your floor plan and market.

References

- Topgolf: About Topgolf Entertainment. Topgolf official site. Accessed 2025-12-04. https://topgolf.com

- Golfzon: Company & Product Information. Golfzon official site. Accessed 2025-12-04. https://www.golfzonglobal.com

- HitTrax: Case Studies & Product Info. HitTrax official site. Accessed 2025-12-04. https://hittrax.com

- TrackMan: Technology Overview. TrackMan official site. Accessed 2025-12-04. https://trackman.com

- IAAPA: Industry Insights for Family Entertainment Centers. IAAPA official site. Accessed 2025-12-04. https://www.iaapa.org

- Grand View Research: Virtual Reality Market Size & Trends (for context on immersive entertainment growth). Accessed 2025-12-04. https://www.grandviewresearch.com

- JAMMA Amusement: Company and product information. https://www.jammapark.com/. Accessed 2025-12-04.

How to Choose the immersive entertainment manufacturer and supplier ?

How to Choose the golf simulator brands manufacturer and supplier ?

Top 10 5d interactive motion picture cinema Manufacturers and Supplier Brands

How to Choose the 7d dark rides manufacturer and supplier ?

Product details

Are glasses required to see a 5D film?

Audience needs to wear 3D glasses while watching movie, but not VR glasses.

How many players can play soccer at the same time?

Up to 4 players can play at the same time, you need to add more soccer balls.

Does the soccer simulator configuration include the curtain?

Yes, a 4-meter-wide, 3-meter-high projection curtain is included.

Standard and other

What is the delivery time?

Usually the production period of our products is 20 to 25 days, it will be a little different according to the quantity of products you order. All products need to go through our strict quality inspection before shipment. After they are tested, we will ship them to you at the first time. For products in stock, we usually ship within 3 days.

Do you offer a customized service?

We can provide logo customization service for all of our products. For certain products, we can also support customization of sizes and game content. If you have any product customization requirements, please contact us and we will confirm the details with you.

Hottest activated LED dance grid tiles floor touch games

Super Grid is an immersive sports game that combines sports and technology. It integrates interactive LED lights and sensors through innovative software design, creating a fun gaming experience.

Top Indoor Tennis Racketball Training Simulator Dual Player Games

Interactive somatosensory fitness game

Combine traditional tennis sports with advanced 3D digital technology to bring customers an immersive tennis training experience

COMBINE TRADITIONAL TENNIS SPORTS WITH ADVANCED 3D DIGITAL TECHNOLOGY TO BRING CUSTOMERS AN IMMERSIVE TENNIS TRAINING EXPERIENCE INDOOR AND TENNIS EXPERIENCE HALL

Super Grid Interactive LED Floor Activate Game Team Play

Super Grid is an immersive sports game that combines sports and technology. It integrates interactive LED lights and sensors through innovative software design, creating a fun gaming experience.

Immersive 5D/7D/9D cinema dynamic visual experience room

Compared with other types of theaters, 5D/7D/9D cinema have high technical content, prominent themes, and have a strong impact on the characteristics of the picture. With the increasing demand in the entertainment market and the continuous development of video entertainment technology, in the past, audiences would experience vibration, drop, rain, scratches and other effects in some 4D theaters, but now with 5D theaters, audiences can experience new Unique features, touch and feel effects such asreal smoke, water, snow, bubbles, smell, lightning, leg touch,camera system and more. When the audience is watching amovie, the seats and environmental effects will change into corresponding actions according to the development of the movie,allowing the audience to experience an immersive viewing experience.